Worker-consumer synchronicity

February 18, 2025

Last week’s consumer sentiment data flashed a yellow light of caution that the consumer resilience that has powered the U.S. economic engine over the last four years is sputtering.

Consumer retail sales in January fell by 0.9 percent from December, a much stronger pullback than economists had expected. The spending decline was broad-based, meaning that even colder-than-average temperatures across much of the country couldn’t completely explain the magnitude of the slowdown.

Over the past four years, economists have gotten used to workers and consumers being in sync. When workers are doing well, so are consumers, and vice versa. A robust job market has been a key factor in the consumer resilience that has boosted spending.

While hiring remained strong in January, ADP employment data shows that consumer spending is leaning on a labor market that, while far from wobbly, isn’t as strong as it was last year.

The struggle is real

Last year, ADP Research surveyed 38,000 workers on six continents around the world. We found that record high global employment, as reported by the OECD, collided with a rising cost of living to produce a mixed outcome for the global workforce.

More than half of respondents to our Global Workforce Survey said they were living paycheck to paycheck. And working adults in the United States stood apart from those in other high-income countries in the proportion of workers who said they were struggling to make ends meet.

Sixty percent of U.S. workers old us they lived paycheck to paycheck, a larger percentage than every other G7 country except Italy, which came in at 63 percent. In Canada, 56 percent of workers said they were living paycheck to paycheck, in Germany it was 51 percent, in the UK 49 percent, in France 43 percent, and in Japan 23 percent.

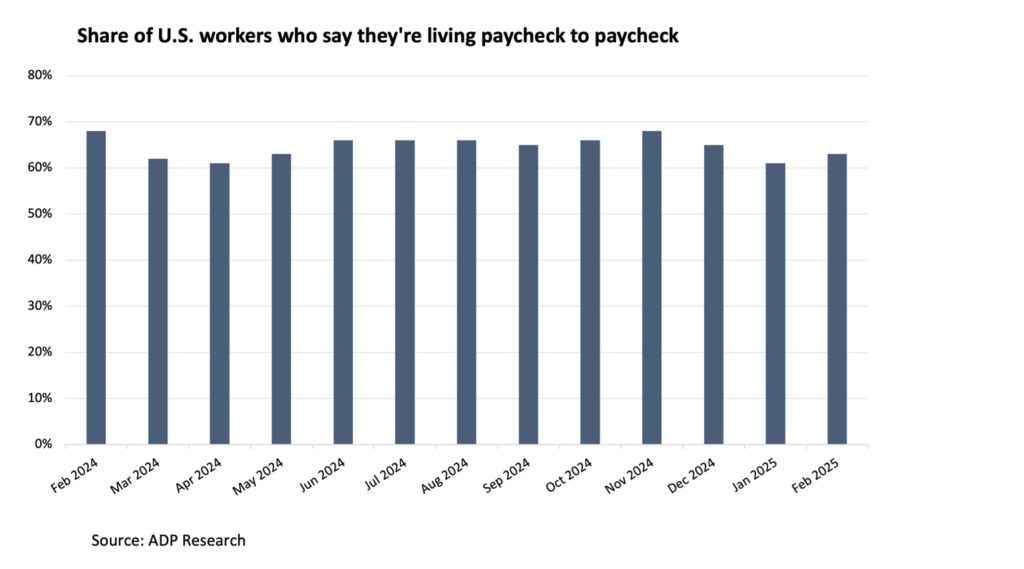

For the past 12 months, ADP Research has included a question in a separate monthly survey of 2,500 workers in the United States. Data from this survey aligns with data from our 2024 global survey. In February, 63 percent of U.S. workers said they were living paycheck to paycheck.

When two-thirds of workers feel pinched, any slowdown in pay growth could tip the scales from consumer spending resilience to consumer spending reluctance.

New hires are taking a pay hit

Another sign that the job market could be contributing to softening consumer spending is the experience of new hires, people who joined their employers in the last three months.

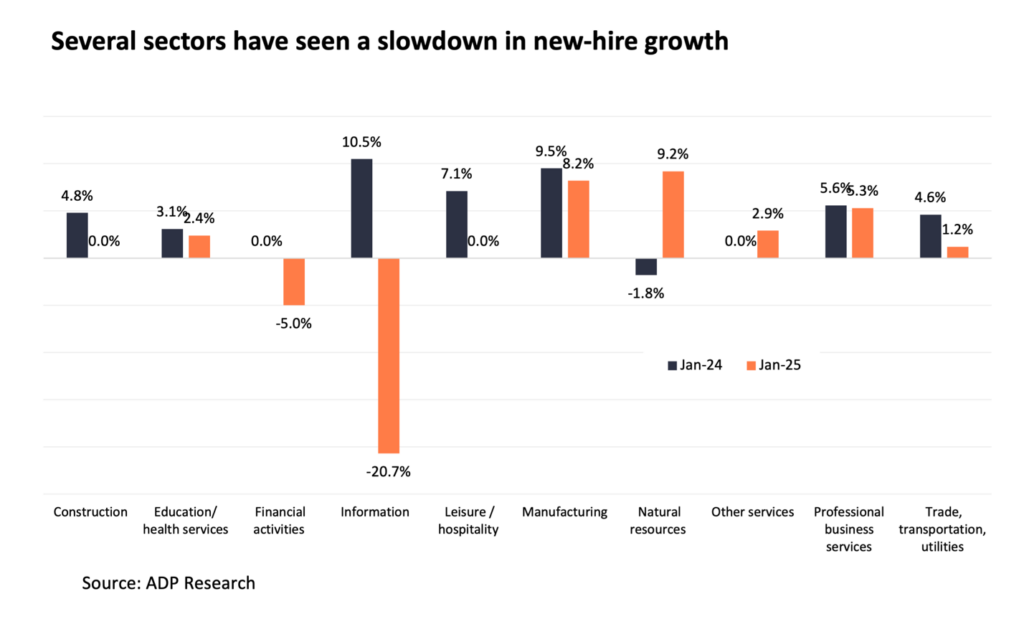

New hires today aren’t commanding the same salaries as they a year ago. While overall hiring is strong, ADP data shows that pay growth is on the decline in several industries.

In January 2025, the typical new hire made $18 an hour, a pay rate that was unchanged from January 2024. By contrast, year-over-year pay growth for new hires was 4.3 percent between January 2023, when new-hire pay was $17.30 an hour, and January 2024.

Some industries have experienced an actual reduction in median pay for new hires. In financial services and information, new hires are making less per hour this year than they did a year ago.

The reason isn’t that employers are cutting salaries. Rather, the job mix has changed. Employers are hiring for positions that command lower salaries because they’re less senior or require fewer skills. This hiring trend toward less-skilled and less-tenured talent could signal that employer demand for high-paid workers is starting to wane.

More part-time jobs

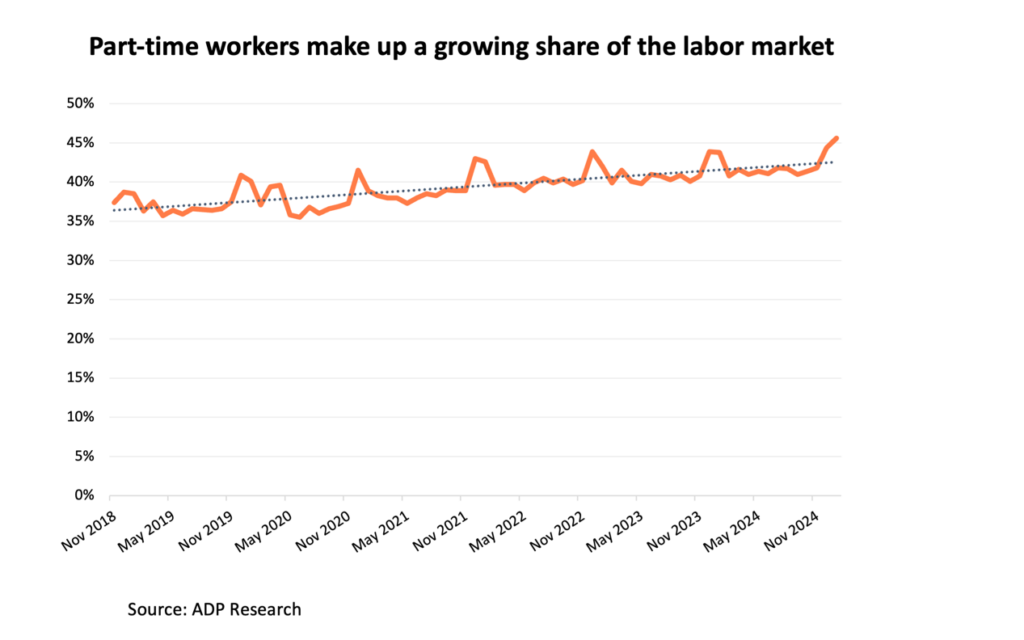

We also took a deep dive into the composition of the labor market using ADP data on hourly workers. Hourly workers make up approximately 60 percent of the labor force.

Over the past three months, the share of hourly employees working less than full time (35 hours a week) has been creeping up. In January, the share of part-time share of jobs grew to 45.6 percent from 43.8 percent a year prior and the largest share we’ve seen since the start of the series in November 2018, when part-time workers made up just 37.4 percent of the labor force.

Payroll data can’t tell us whether workers are choosing to work less than full time or whether employers prefer part-time to full-time workers. We can say that in today’s labor market, fewer hours worked means lower annual pay, which could dampen spending.

My take

U.S. consumer strength in the face of higher prices is due in large part to the solid job market and strong hiring. Cracks are forming beneath the surface of this labor market bedrock, however, and threaten to spill over to the consumer.

It’s far too soon to know if one cold month of slower-than-expected retail spending signals a broader chilling of consumer spending. With inflation still too high for comfort, however, any step back in the job market could mean a step back for consumer resilience.

The week ahead

Wednesday: The week after the Super Bowl marks the unofficial start of spring homebuying season. January housing data, beginning with the Census Bureau’s residential construction report will show how the market is adjusting to higher mortgage rates and low affordability.

Thursday: Department of Labor data on initial jobless claims, a proxy for layoffs, have hovered near 50-year lows for the past two years. If this stability continues, it could help offset last week’s lower-than-expected January retail numbers.

Friday: I’m watching National Association of Realtors existing home sales data for a surge in housing inventory to get the 2025 homebuying season off to a strong start.