Word of the year: Stability

December 16, 2024

|

The path to becoming a Merriam-Webster or Oxford word of the year differs, but the goal of each is the same: To capture society’s mood or ethos over the past 12 months.

In keeping with the spirit of these annual pursuits, I’ve come up with my own word to describe the vibe of the 2024 labor market: Stability.

Here’s why stability wins the word of the year for me, and why its days as an apt description of the labor market are numbered.

Workers are staying put

By almost every measure, workers are sticking with the same employer. The quits rate as measured by the Bureau of Labor Statistics is down nearly 9 percent from 2023. Initial jobless claims, a proxy for layoffs, has been at historically low levels for the past two years.

ADP Research has the unique ability to measure turnover using payroll data. We calculate the number of employees who separated from their employer in the previous month, then divide that by the number of employees still active on the payroll.

By this metric, turnover was 4.9 percent heading into the fourth quarter. That’s a slowdown from the 5.6 percent turnover we saw at the same time last year.

These three measures confirm that neither workers nor employers made big changes this year.

Sticky inflation meets stable wage growth

If the labor market word of the year is stable, then sticky is the word that best describes inflation in 2024.

The Consumer Price Index measure of inflation edged up from 2.6 percent in October to 2.7 percent in November. When stripped of volatile food and energy prices, core CPI held at an annual rate of 3.3 percent for both October and November.

Wages are similarly stuck at higher levels. ADP data shows that pay growth for job-stayers and job-changers accelerated in November. But when we dive deeper into pay for hourly workers, sticky inflation is having an impact.

Median hours worked for hourly employees fell 0.9 percent, to 38 hours in November from a year earlier. Because these people are working less, their annual gross pay growth is slowing. Annualized pay for hourly workers was up 2.8 percent in November 2024, compared to a 3.2 percent increase in November 2023.

With inflation at 2.7 percent, that 2.8 percent growth in wages for hourly workers all but vanishes.

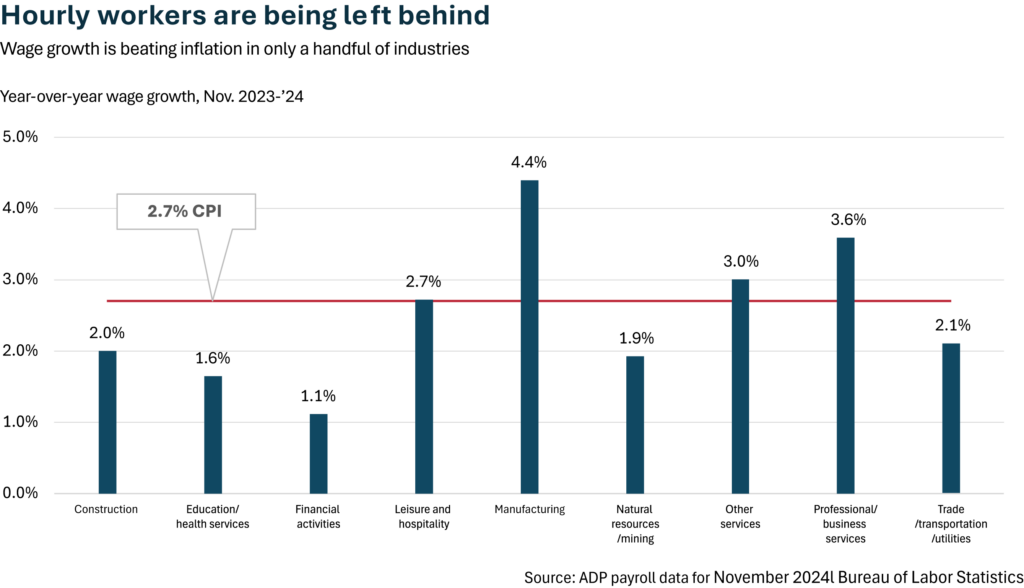

And those wage gains are being driven by strong growth in select sectors. In information and manufacturing, growth in hourly gross pay exceeds CPI by nearly 2 percentage points.

In construction, education and health services, finance, natural resources and mining, and trade, transportation and utilities, the pace of pay growth is less than inflation. That suggests that average real wages in these sectors are stagnant or falling.

Worker attachment to their employers is slipping

Each month, ADP Research asks workers in the United States how they feel about their jobs. By asking questions of a statistically robust sample of people, the Employee Motivation and Commitment Index, or EMC Index, provides a measure of worker loyalty.

Worker sentiment has been strong in 2024, beating last year’s levels. Over the last three months, however, it’s begun to slip.

Worker sentiment as measured by the EMC Index is linked to productivity and employee retention, which means we might be entering 2025 with a less stable workforce.

My take

They say that still waters run deep. On the surface, the labor market looks stable, but underneath, questions are bubbling up that could cause ripples, or churn, in 2025.

Will consumer spending and demand for services remain strong enough to support hiring in consumer-facing sectors such as leisure and hospitality? Will worker sentiment stay positive? If people are working less, can salaries for hourly workers keep pace with inflation?

Will 2025 be the year that manufacturing, after a boost from lower interest rates, starts adding jobs instead of shedding them? Will health care become the new stalwart of the labor market, as the U.S. population continues to age? When—and where—will we see AI jobs?

In 2024, the economy went from recovery and growth mode to stabilization mode. Demand and supply for workers came into balance.

While stability captures the mood for 2024, it quickly will go out of date in 2025 as undercurrents of change rise to the surface of the economy.

Main Street Macro will be on hiatus for the holidays. We’ll see you back in this space in January. Until then, happy New Year to you and yours.

The week ahead

Tuesday: A heavy data week kicks off with a fresh read on retail sales from the Census Bureau. The ADP Research EMC Index for December also is released today. With consumer confidence improving and worker sentiment edging down, consumer spending hangs in the balance.

Wednesday: The Federal Reserve’s December rate decision, due today, has been long awaited and debated. Housing’s shadow over inflation also will be watched closely today when Census releases starts and permits data for November.

Friday: The week ends with a cliff hanger, as fresh data on the Fed’s preferred measure of inflation, the Personal Consumption and Expenditure (PCE) Index sets the tone for next year – will sticky inflation continue?