When the economic data is confusing, take a closer look

November 04, 2024

|

On Friday, the Bureau of Labor Statistics reported that private employers had shed 28,000 jobs in October. Just days earlier, ADP data had shown that the private sector had added 233,000 jobs.

It’s enough to give anyone mental whiplash. But the numbers beg an obvious question: Is the economy strengthening, or weakening?

To me, the answer is simple: The economy might not be perfect, but it’s strong and growing.

Here’s what’s behind these divergent reports.

The economy is adding jobs

On Friday, the BLS said U.S. non-farm payrolls had grown by 12,000 jobs, led by government hiring. That was a big drop from the 194,000 jobs, on average, that the economy had gained over the preceding 12 months, according to government data. The bureau reported that private employers had lost 28,000 jobs.

The government data was in sharp contrast to the ADP National Employment Report released just days earlier, which reported that private payrolls had expanded by 233,000 jobs. Those healthy job gains were broadly distributed across industries, geography, and employer size.

In fact, after a summer of relative malaise, hiring has strengthened over the last two months, even in the aftermath of hurricanes Helene and Milton. Private-sector job gains for October were at their highest since July 2023.

And while growth last year was driven by gains in leisure and hospitality, October data shows resiliency across all major sectors. Manufacturing was the only sector to lose jobs, as it has for five of the last six months. This manufacturing weakness shows up in both ADP and BLS job data.

Overall, ADP data showed a strengthening labor market, while the BLS showed a drastically weakened one.

While these reports measure job gains differently, they should point in the same direction over time. To explain big disparities like the one we saw in October, it helps to understand how ADP and the BLS measure the job market.

ADP and the BLS both assess market conditions during a reference week that includes the 12th day of the month, but the data they collect during that period is very different.

The ADP National Employment Report measures the number of people on private-sector payrolls. Our report isn’t affected by, say striking workers, who remain on the payroll even if they’re not actually getting paid. We also count people as employed even if they’re unable to work due to hurricanes or other upheavals.

In contrast, BLS data is built on a monthly survey of government and private establishments, which are asked how many of their workers actually received a paycheck during the reference week.

Responses to the BLS establishment survey have been falling and stood at a low 43 percent in June.

In October, the BLS attached a notice to its job report, noting that its survey response rates were “well below average” in both “storm-affected areas and unaffected areas,” meaning response rates were low nationwide.

Hurricanes affected the data, but not by much

ADP can calculate the number of employees who are paid weekly, which gives us a snapshot of what happened in storm-affected regions during the BLS survey period.

In Florida, Milton coincided with a 0.5 percent to 1 percent drop in the number of weekly paid employees, Helene coincided with an additional 1.5 percent to 2 percent drop.

In North Carolina, we attribute a 3 percent drop in weekly paid employees to Milton. We did not see an effect with Helene.

The number of weekly paid employees in both states had rebounded by Oct. 20 to near or above pre-hurricane levels.

We also saw a substantial decrease in the number of hours worked in Florida, but little evidence of reduced hours in North Carolina. Median hours worked in Florida fell to 36.1 in October from 37.9 hours in September, a substantial decline. The national median was unchanged, at 38.3 hours worked in October and September.

BLS also had warned that the storms would be more likely to affect hours worked than hiring, however government data showed that the length of the workweek held steady from September to October.

Pay data suggests a balanced labor market

Despite solid hiring, the pace of pay growth continued to slow in October. Pay Insights data from ADP Research provides an apples-to-apples comparison of pay growth by measuring how pay for individual workers has changed from 12 months ago. We aggregate individual data to determine the median pay change for all workers.

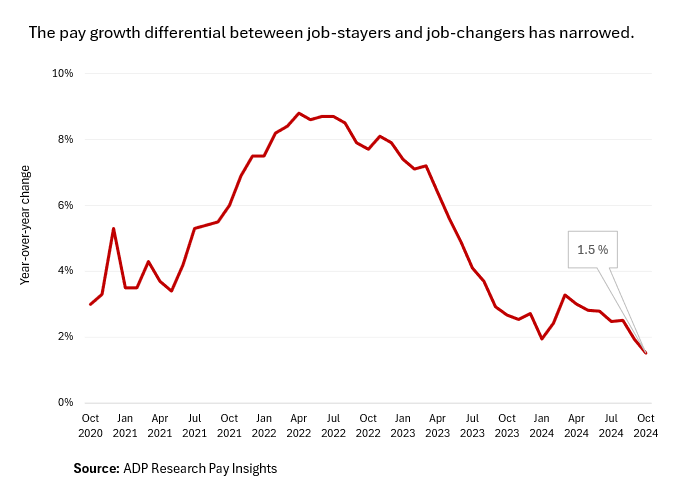

For people who were in the same job a year ago, who we call job-stayers, year-over-year pay growth slowed to 4.6 percent in October, continuing a two-year deceleration. Pay for job-changers, or people in a job different from the one they had 12 months ago, pay growth slowed to 6.2 percent from 6.7 percent in September.

And the difference between pay gains for job-changers and job-stayers is the smallest we’ve seen in the four years we’ve been recording the data. This narrowing gap supports the view that labor supply and demand are in balance. It’s unlikely that wages will trigger another pickup in inflation, despite strong hiring.

Wages adjusted for inflation remain positive and should continue to support consumer spending.

Workers are content

Much has been said lately about inflation and consumer discontent, but workers are singing a different tune. For the past two months, people we survey are feeling more loyal to their employers and more engaged in their work.

The Employee Motivation and Commitment Index, a measure of worker sentiment, fell four points in October to 131, but remained near a record high of 138 set in June. Most sectors remained relatively stable.

The index, developed by ADP Research to track how people think and feel about their jobs and employers, is based on monthly surveys of 2,500 U.S. workers. By providing a real-time measure of the state of worker allegiance, it can tell us whether people are flourishing in their jobs or detaching.

Initial jobless claims, a proxy for layoffs, are near record lows, so it’s no wonder that workers are feeling pretty confident about both their jobs and career prospects.

My Take

We can’t expect all economic indicators to agree every month, but BLS non-farm payroll data and ADP’s National Employment Report should trend in the same direction. Prior to October, they were.

In a murky data environment like this, there are two ways to make a dark picture clearer. The first is open the aperture and admit more light.

The difference between the ADP and BLS jobs reports is not a bug, it’s a feature. ADP data captures weekly payroll employment of some 25 million workers.

Federal statistical agencies remain the gold standard of macroeconomic measurement, but private-sector data can complement government survey-based indicators with a more granular, higher-frequency view. In a month marked by hurricanes and strikes, it helps to have a second source of light-generating data.

The second way to make a picture clearer is to adjust the focus. While job creation is and likely always will be the headline of every major labor report, wages are critical to the economy, business profitability, and worker wellbeing.

The proof in the pudding of any market is prices. In the job market, the price of labor is measured in pay. The U.S. labor market has largely recovered from the pandemic-era labor imbalance that drove up wages.

For employers, this new balance has made it easier to hire. For workers, pay growth is outpacing inflation, so real wages are growing.

Other data released last week mirrors these points. The economy grew by an estimated 2.8 percent in the third quarter and annual consumer spending rose by a robust 3.7 percent in September. Consumer spending, which drives the lion’s share of economic growth, remains solid, supported by a healthy and strengthening job market. Inflation is nearing the Federal Reserve’s target rate of 2 percent.

Look at the whole picture, you’ll see an economy that has stuck its soft landing.

The week ahead

Tuesday: Presidential and congressional elections don’t have an immediate effect on the economy, but changes in government spending and policy could alter the course of inflation, hiring, and worker and consumer sentiment over time.

Thursday: Federal Reserve policymakers will announce their next rate decision. Judging from Wall Street’s upbeat response to Friday’s downbeat jobs data, markets are expecting a second rate cut. I’ll also be watching the Bureau of Labor Statistics release on productivity, the economy’s secret sauce.