The strength of a boring economy

October 21, 2024

|

The 2024 economy has become boring. Despite being jostled by extraordinary events such as back-to-back hurricanes, interest rates near 20-year highs, and geopolitical events, the economy is humming along.

Recent data on consumer spending, corporate profits, and worker retention confirms this resilience, and help explain why a boring economy just might be, for now, the best kind of economy.

Normal consumer spending

The 2022-2023 surge in inflation hit consumers hard, especially coming on the heels of the pandemic’s chaos and upheaval. But recent consumer data shows little evidence of the challenges that seemed almost insurmountable just four years ago.

Retail sales climbed by 0.4 percent in September from August and were up 1.7 percent year over year. It’s not a dramatic jump for the month, only the fourth-biggest of the year, but that 0.4 percent matches the data’s 30-year average, suggesting the rate of growth of consumer spending is-wait for it-normal.

No-drama business investment

Over the next three weeks, the large public companies that comprise the S&P 500 will be reporting third-quarter earnings results.

There has been positive year-over-year earnings growth for four consecutive quarters, according to an analysis from FactSet.

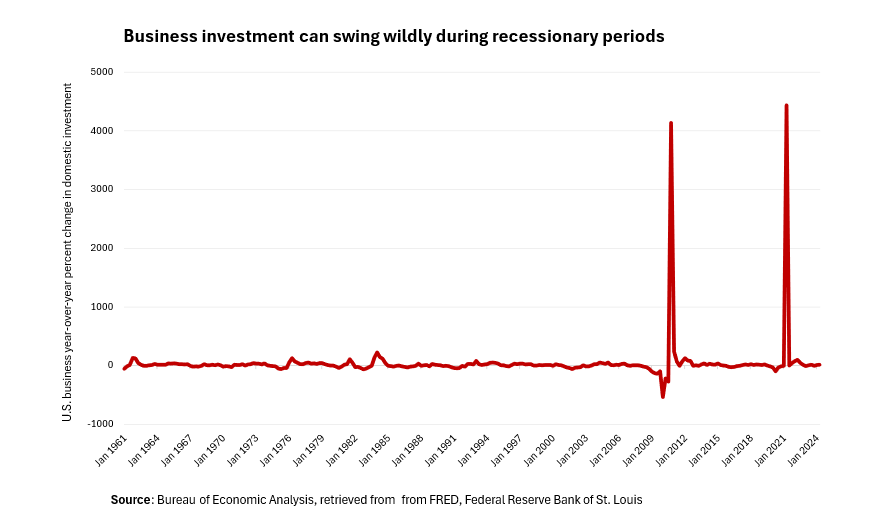

Profits are an important source of funding for business investment, which drives productivity and economic growth and can swing wildly during recessionary periods.

Despite being a growth year for the economy overall, 2023 was marked by a tremendous swing. Business investment shrank by nearly 10 percent in the first quarter, grew in the second and third quarters, and fell again in the fourth quarter. So far this year, business investment has advanced at a healthy and steady clip, advancing 10 percent in the first quarter and 17 percent in the second quarter.

No-drama business investment is another reason the economy is growing faster than expected this year.

Stable job market

The labor market recently delivered one of the most economic exciting data points of 2024, when employers added 254,000 jobs in September, well above the average of 139,000 over the preceding three months.

Other labor-market indicators have been less thrilling. Individual pay gains, for example, have been stable, according to ADP Pay insights data, and the shrinking pay growth differential between job-stayers and job-changers reflects a good balance of worker supply and employer demand.

A jump in initial jobless claims, a proxy for layoffs, in the aftermath of hurricanes Helene and Milton has already retreated, falling from 260,000 to 241,000.

My take

The last five years have primed us for jump scares and drama when it comes to the economy. As we enter the last three months of the year, reality is a lot less exciting. The economy is on a steady march, refusing to be tripped up by even remarkable events.

It harkens back to the 10 years that preceded the pandemic. This period was the longest expansion in U.S. history, but also one of the slowest. The tortoise-like pace of economic growth kept inflation low.

Today’s inflation has begun to retreat but is still too high. To bring it down further, our boring economy might just be the one we need right now.

The week ahead

Wednesday: Investors will be paying close attention to corporate earnings, but my focus will stay on Main Street and the real economy. Data to watch starts with September existing home sales and the Federal Beige Book. Both releases give a rear-view look of economic fundamentals for growth as we head into the third quarter.

Friday: Last week’s retail sales data showed that consumer bypassed big-ticket items such as furniture, cars, and other durables in favor of spending on restaurants and clothing. Data on orders of durable goods will turn a magnifying glass on demand for expensive items to look for any weakness beneath the surface of consumer strength.

ICYMI: How is artificial intelligence changing the workforce? Tune into a World Economic Panel on Skills in the Age of AI, where I share thoughts on what workers will need to thrive amid massive advances in technology.

ADP Research shows that employee sentiment dipped in October, but most sectors remained relatively stable (boring).

Main Street Macro will be on hiatus next week as we prepare the October National Employment Report, our last job report before the Federal Reserve’s next rate decision.