Main Street Macro: Three job questions for the next six months

July 01, 2024

|

Over the past six months, the job market has proven to be the most consistently upbeat indicator of the U.S. economy.

Hiring didn’t surge like the U.S. deficit, which the Congressional Budget Office projects will increase by more than $400 billion to $1.9 trillion this year, the third-largest deficit on record, behind 2020 and 2021, when pandemic relief spending pushed it to a record high.

Hiring hasn’t stalled like inflation. The Federal Reserve’s latest data showed inflation cooling, but the central bank expects year-over-year growth to increase in coming months.

Hiring hasn’t been weighed down by weak consumer sentiment. And it isn’t plagued by high interest rates and prices like the housing market. Home sales slumped in May while median prices rose 5.8 percent to a record high.

In contrast to these segments of the economy, the labor market has been reliably positive, posting solid gains every month while keeping a lid on wage growth.

Now, as we pass the midpoint of 2024, three questions will guide the labor market’s reliability for the rest of the year.

How cool is cool enough?

Economists always look for equilibrium. For jobs, this is called the natural rate of unemployment, the rate at which the labor market neither accelerates nor drags down inflation.

For a long time, economists put the Goldilocks unemployment rate at around 5 percent. That perception changed leading up to the pandemic, when unemployment dipped to less than 4 percent and inflation stayed low.

After our recent bout of inflation, the new sweet spot for unemployment remains in question. Is less than 4 percent consistent with low inflation?

Will wage growth continue to slow?

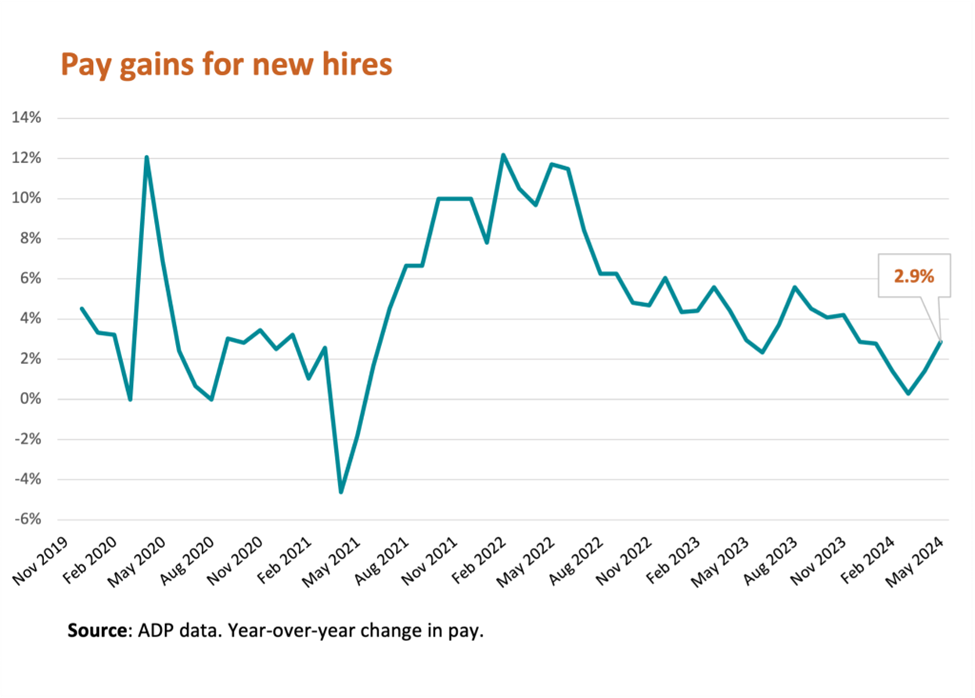

ADP Research analyzes more than 20 million individual paychecks each month. In May, more than a million of these workers were hired in the last three months.

Year-over-year pay growth for these new hires was 2.9 percent, the highest in six months. That’s a far cry from the peak wage growth for new hires of 12 percent in early 2022, but pay growth is heating up again. In April and March, year-over-year pay gains for new hires were just 1.4 percent and 0.3 percent, respectively.

When we look at the anonymized records of individual job changers, pay was up 7.8 percent year over year. While these gains have been slowing, there’s reason to believe they could stall or even accelerate in the coming months.

Now that inflation as measured by the Personal Consumption Expenditures Price Index, the Fed’s preferred measure, has reached 2.6 percent, it’s an open question whether wage growth is still too high for inflation to fall to less than 2 percent.

Where is the job growth?

Job growth has been strong but not broad-based. Service providers, namely leisure and hospitality and health care employers, drove the lion’s share of gains in the first half of 2024.

Consumers are starting to feel the fatigue of higher prices. Consumer spending was up just 0.2 percent in May from the previous month after being revised down to 0.1 percent in April, both lower than economists expected.

The question for the job market is whether relentless consumer demand will ease. If it does, will that influence hiring in the service sector?

My take

Occasionally, I get an opportunity to speak with employers. Whether big or small, they have remarkably similar questions about the economy. Two years ago, employers were asking how to compete for talent and retain their workforce.

This year, the questions have changed. Executives want to know how to increase worker engagement and enhance productivity. They’re not trying as hard to get more people in the door; they’re trying to make the people they have more productive.

This shift is playing out in the labor market. What’s ahead will be more strategic hiring and compensation plans.

These micro decisions at the employer level are driving an inflection in the labor market that will play out over the next six months, pushing us toward a slower but still-reliably supportive job market.

The week

Tuesday: Job openings, hiring, and quits data from the Bureau of Labor Statistics will set the tone for the week. Openings have fallen to closer to pre-pandemic levels, and any signs of a continuation of the Great Resignation were extinguished months ago.

Wednesday: The ADP National Employment Report on private-sector hiring for June is released, along with a look at real-time wage growth from Pay Insights.

Friday: The BLS releases its first take on job creation in June. Hiring surprised economists last month with a strong print of 272,000 new public- and private-sector jobs. Average hourly earnings increased by a robust 4.1 percent from the previous year, and the unemployment rate inched up to 4 percent. That gives us three reasons to watch this report carefully.