Main Street Macro: That new-hire glow is fading

October 23, 2023

|

With analysis by ADPRI senior data scientist Liv Wang.

Over the last few weeks, data on the economy has left us with a question. We’ve learned that job growth is still solid. Openings are still strong. So what about the Great Resignation? Is it still great?

The short answer is no. Looking deep into ADP payroll data, we found evidence that the warm glow that new hires enjoyed during the pandemic – a contentment fueled largely by big pay increases – is fading fast.

Small numbers

Let’s first look at how great the Great Resignation really was.

The ADP Research Institute examined a broad sample of new hires – workers who started with an employer in the last three months — regardless of whether or not their former employer was an ADP client.

New hires are highly sensitive to real-time labor market conditions, more so than other workers. The types of jobs they find, the levels of seniority they attain, the location of their work, and, importantly, the salary they command all hinge on the particular hiring needs of millions of employers and the preferences and skill sets of millions of competing job candidates.

Those constraints can serve to discourage job-switching. In fact, the labor market’s share of new hires – those workers who started new jobs in the last three months – averaged only 4.3 percent in the first nine months of 2023, down from 4.8 percent in 2022.

Even during the Great Resignation, when hiring demand soared and the promise of a bigger paycheck had people eager to change jobs, the average share of new hires peaked at just above 5 percent.

Slowing pay growth

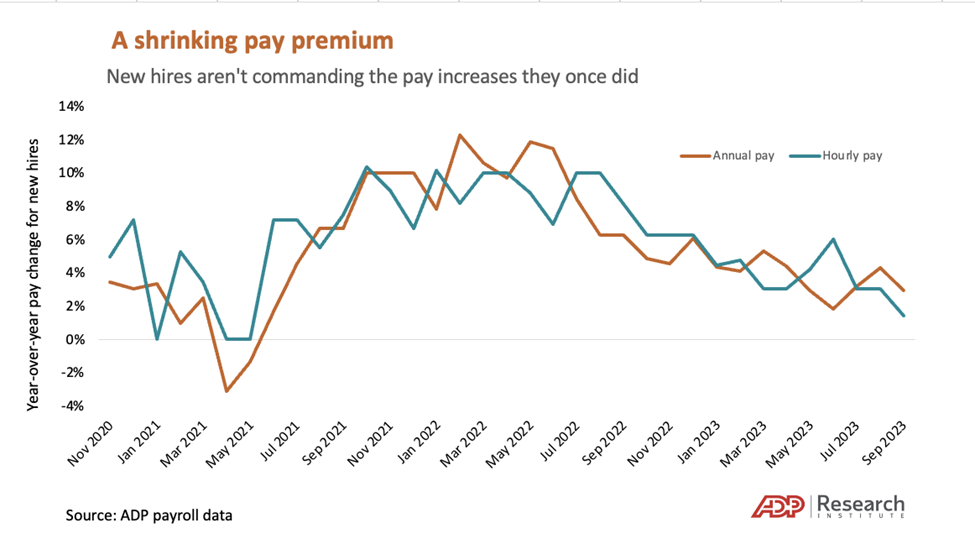

Money typically gives momentum to job-switching. In 2022, a new hire could expect to see a 10 percent jump in pay compared to a new hire in 2021. Before the Great Resignation peaked last year, median annual pay growth for new hires in 2021 and 2020 topped 6 percent.

More recently, year-over-year pay growth for new hires has fallen dramatically, reaching just 2.9 percent in September.[1]

[1] We also track a subsample of job-switchers over a course of the year in ADPRI’s monthly Pay Insights report. Pay Insights shows 9 percent year-over-year increase for job-switchers. These workers tend to have more tenure and higher salaries than the general population of new hires cited here. Yet even among this sample, median annual pay growth has fallen from its peak of more than 16 percent last year.

Pay is going nowhere fast. New hires who are paid by the hour make up about 60 percent of our sample. For them, median hourly pay has been stuck at $17 since February.

It’s not just hourly workers. White-collar fields such as finance, information, and professional business services were fairly well insulated from the ravages of the pandemic and experienced relatively little job loss. Many of these jobs could be done remotely, which helped to limit the disruption.

Today, white-collar wage growth has faltered. For new hires in finance, pay growth has been at a literal standstill – zero – since July. New hires in the information sector have it even worse. Their annual pay began falling in January and has continued to contract for six of the past nine months.

As an industry, professional business services historically is responsible for the largest share of new hires in recent years, with more than 1 in 5 workers in this sector joining in the last three months. But when it comes to pay, those recruits fared worse than their peers in every other industry, with their year-over-year pay falling 1.4 percent in September.

My Take

The slowing trend in new-hire pay growth stands in sharp contrast to the stronger-than-expected data on jobs, consumer spending, and inflation that we’ve seen in the past month.

Unlike those government indicators, the ADP Research Institute has real-time data on the state of the private-sector labor market. Our data on new hire pay points to a labor market that is still expanding, but without the super-sized pay growth of the past two years.

The lure of more money isn’t the only reason workers quit their jobs. The promise of improved prospects, better work-life balance, greater benefits, a welcoming workplace culture, and quality management all can influence an individual’s decision to quit or stay.

Still, as the pay premium for new hires shrinks, the decision to stay is more likely to be the one that sticks. A version of this post was published on Fortune.