MainStreet Macro: Pay Day

September 06, 2022

|

Pay is going up, but the details matter

Private employment topped its pre-pandemic high for the first time last month. ADP’s newly relaunched National Employment Report showed gains, and Friday’s government jobs report found that total employment was 240,000 higher than its February 2020 peak.

Yet with unemployment near record lows — 3.7 percent — and job postings near record highs, the labor market is still tightly wound. There aren’t enough workers to fill all the vacancies.

The result? You guessed it: higher wages.

The National Employment Report’s pay tracker revealed some new insights.

Pay growth is strong, but flattening

The NER’s Pay Insights tracks gross earnings, including tips, bonuses, and commissions.

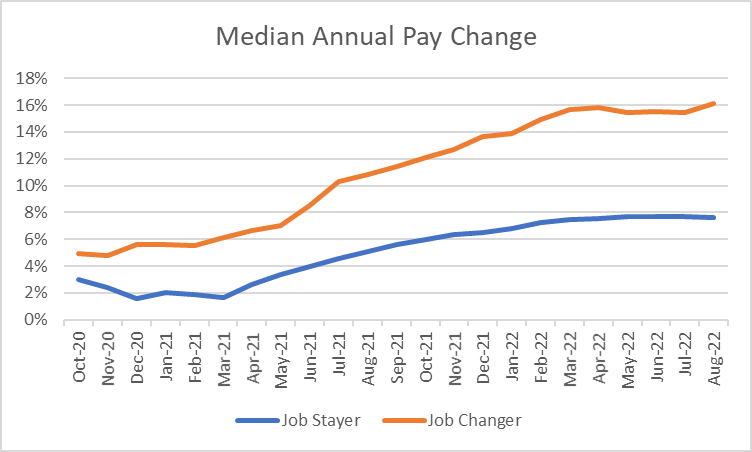

Using our massive payrolls data set, Pay Insights tracks unique employee-employer pairings – which we label jobs. If a job shows up in both the current month and the same month from a year earlier, the associated pay change is included in our topline tracker of job-stayers.

The change in annual pay was 7.6 percent in August, in line with monthly readings since spring. In early 2021, annual pay increases were running at only about 2 percent. Pay growth has leaped over the course of last year.

While the pace of pay increases is elevated, its growth has flattened over the past several months.

Changing jobs still pays

While our report focuses on the pay trajectories of job-stayers, we also track any job-changers we observe. We’re able to track only job-changers whose previous and current employers both are ADP clients.

One side effect of the great resignation has been labor market churn as workers were lured from one job to another. For those workers, those new jobs seem to have paid off.

As of August, median annual salary for job-changers jumped to 16.1 percent. It was a small downtick from 16.3 percent in July but a big jump from the 10.8 percent we saw in August 2021.

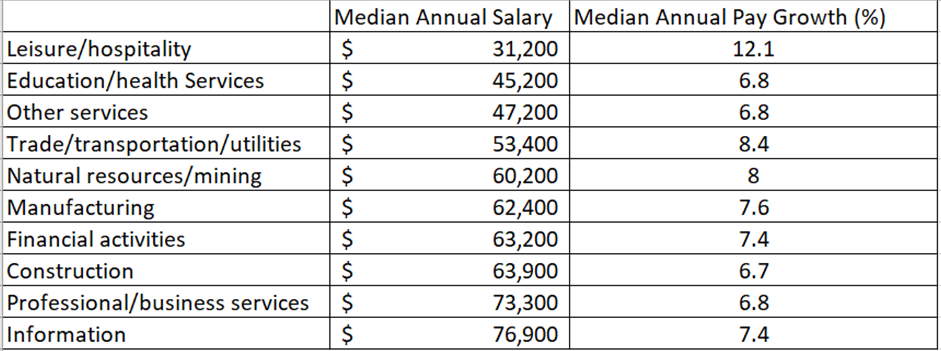

Leisure and hospitality leads pay growth

Service industries saw the biggest pop in pay, including the sector hit hardest by the pandemic, leisure and hospitality.

Despite winning on pay growth, the leisure and hospitality sector actually fares poorly overall when it comes to pay. It has the lowest median salary of the industries we track, at $31,200. That’s less than half that of the highest-paid sector, information technology, which has median annual salary of $76,900.

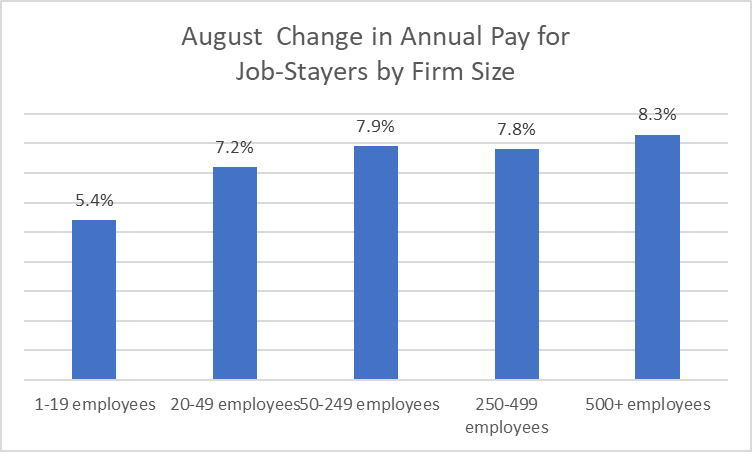

Bigger company, bigger bump

As the labor market has started to pick up steam, employers of all sizes have struggled to add head count due to the short supply of workers.

Writ large, the employer response has been to bump up pay to compete with other firms for talent, and large firms have been able to increase pay more. At firms with 500 or more employees, pay was up 8.3 percent in August from a year earlier. At small companies, pay growth trailed at 5.4 percent in August.

My Take

Are wage increases are keeping pace with inflation? No.

Most workers, in fact, are losing ground to inflation. Even longer-tenured workers who have been in the same job for a year or more can’t escape the inflation quicksand.

Moreover, the biggest percentage pay increases are at jobs that had low pay to begin with

For Main Street to stay sure-footed in its spending, two things need to happen: Pay needs to keep going up, and inflation needs to keep coming down.