MainStreet Macro: Keeping an eye on the ball

May 01, 2023

|

I’m not a great golfer. But in an effort to improve my game, I took a lesson and was struck (no pun intended) by how golf can be applied to the economy.

One thing I learned is to mark the ball. Some golfers look at the putter, others at the hole. But looking at the mark as you swing helps with alignment and focus.

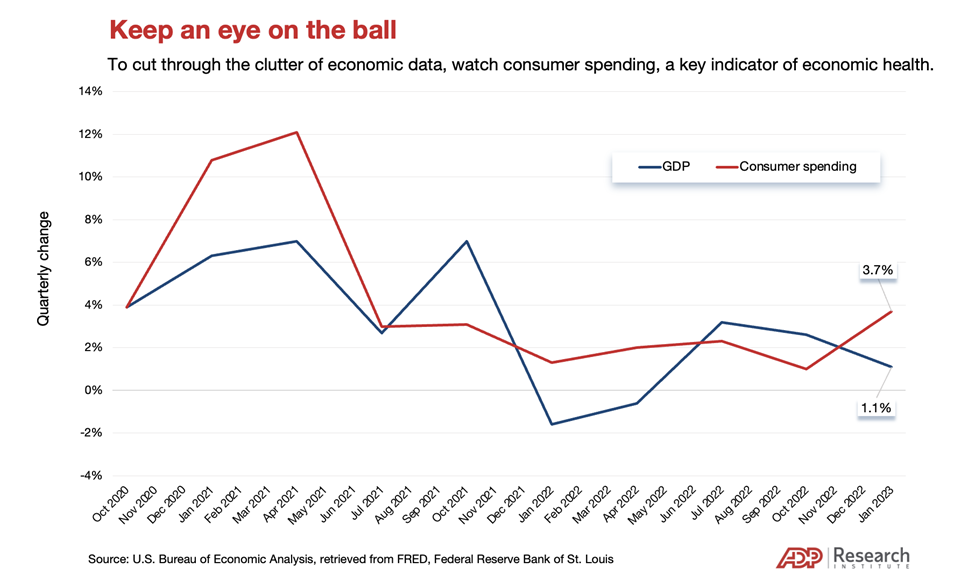

In economics, a profusion of data points is always competing for our attention. Last week, we had gross domestic product, retail sales, and home prices, and that was just for starters. This week, we’ll get job numbers from the ADP research Institute and the Bureau of Labor Statistics, data on manufacturing, and a possible rate hike from the Federal Reserve.

It’s easy to be distracted, and that’s where marking the ball comes in handy. In economics, the ball is the consumer. Spending on personal consumption accounts for 70 percent of the U.S. economy and typically tells us which way things are headed.

With that in mind, here’s what today’s consumer has been up to, and what it means for economic growth.

Gross domestic product

The U.S economy grew by a lukewarm 1.1 percent in the first three months of this year, a significant slowdown from fourth-quarter growth of 2.6 percent.

One big reason for the slowdown was that businesses held back on restocking inventory, which shaved more than 2 percent from economic growth.

The drop in inventories means one of two things. Companies might be positioning for weaker consumer demand and don’t want to be stuck with a lot of excess stuff they can’t sell. Or, inventories might be so depleted that companies are motivated to replenish their stockpiles to meet demand.

The first scenario would detract from economic growth. The second scenario would add to it.

With GDP data pointing in different directions, clarity can be found by looking at consumer behavior.

Consumer spending outpaced the broader economy in the first quarter, accelerating by a robust 3.7 percent, more than three times overall economic growth. But that spending was front-loaded in January and decelerated in February and March, so it bears close watching.

Inflation

Economists measure inflation in a few different ways. One measures what consumers pay for goods and services, known as the Consumer Price Index. Another index tracks prices paid by producers.

The Federal Reserve’s favorite metric, however, is the more comprehensive Personal Consumption Expenditures Price Index, or PCE. This is the index on which the Fed bases its 2 percent inflation target. It’s the most complete indicator of consumer spending.

While GDP growth ebbed in the first quarter, inflation was running hot. PCEaccelerated by an annualized 4.2 percent in the first three months of 2023, compared to 3.7 percent during the last quarter of 2022.

Excluding food and energy, PCE grew at a 4.9 percent annualized pace at the beginning of the year, compared to 4.4 percent in the prior quarter. In other words, inflation got worse over the quarter.

A quarter-over-quarter increase in core inflation is the economic equivalent of a bogey. Amateurs might be OK with the occasional above-par hole, but for pros like the Fed, getting inflation down with the fewest number of rate hikes (or swings) is the best way to win a soft economic landing.

Jobs

Inflation’s overall stubbornness is due in part to tightness of the labor market.

The economy’s plentiful supply of jobs and shortage of workers aren’t making the Fed’s inflation-fighting easy. But this labor market dynamic is supporting Main Street consumers and employers.

Initial jobless claims fell last week after pushing modestly higher over the prior four. And another indicator of labor market strength, the Employment Cost Index, showed companies continue to pay higher wages and benefits to workers.

Companies are still holding tight to workers despite a smattering of headlines to the contrary. So far, the unemployment rate hasn’t budged from near historic lows, despite higher interest rates.

The strong job market means we can expect consumer spending to continue at a healthy pace.

My Take

Next week, Fed policymakers are scheduled to gather again. After taking the lay of the land, they’ll decide whether to take another swing at inflation by raising interest rates.

Whatever they decide, they’ll have their eye on the ball – the consumer, who remains the economy’s most important mark.

As long as companies continue to hire, people continue to spend, and inflation continues to moderate, it’s possible for the Fed to ace this hole and deliver a soft landing that tames inflation without tripping up economic growth.