Main Street Macro: Watching for signs of a rate cut? Keep an eye on these data sets

July 29, 2024

Sometimes the numbers speak for themselves. And for a data-driven Federal Reserve, this week’s cacophony of labor market releases will help shape the timing and duration of future rate cuts.

As such, economists and market watchers will be paying close attention to nonfarm payrolls, the unemployment rate, and average hourly earnings when they’re released Friday.

But there’s much more to this job market than these headline releases. To know what’s really going on in hiring, here are three other data sets worth watching.

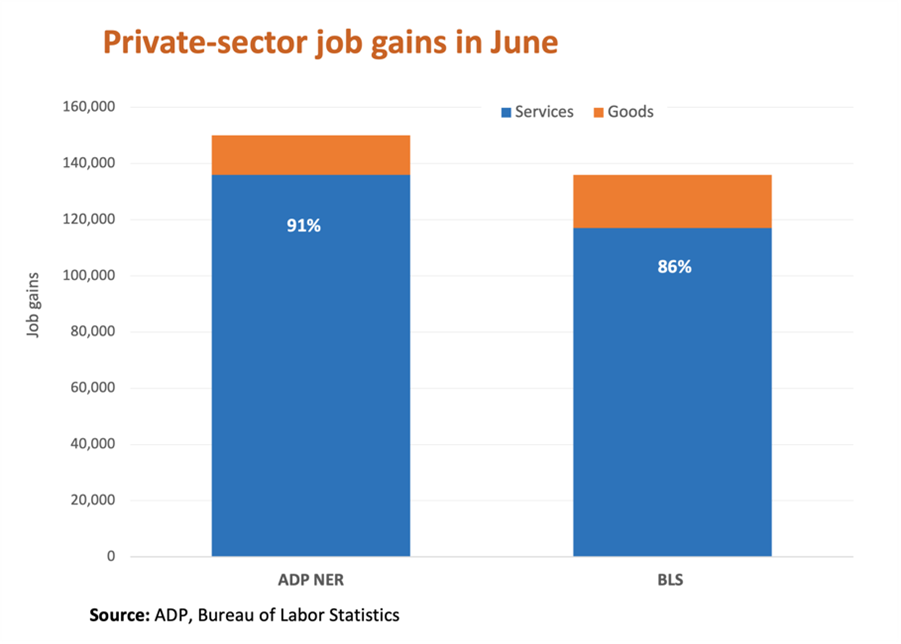

Job-growth concentration

June data emphasized how lopsided hiring has become. The ADP National Employment Report on private-sector hiring showed that 91 percent of the 150,000 jobs created in June came from the service sector. The Bureau of Labor Statistics jobs report showed an almost identical pattern, with the service sector accounting for 86 percent of 136,000 new private-sector jobs.

Moreover, even gains within the service sector were concentrated, with leisure and hospitality driving hiring in ADP payroll data and healthcare leading job gains in the BLS survey.

Without broad-based hiring, it’s unlikely that the job market can remain in equilibrium for long. Data on the makeup of job creation might be the clearest signal of whether normalization of worker supply and demand will be short-lived.

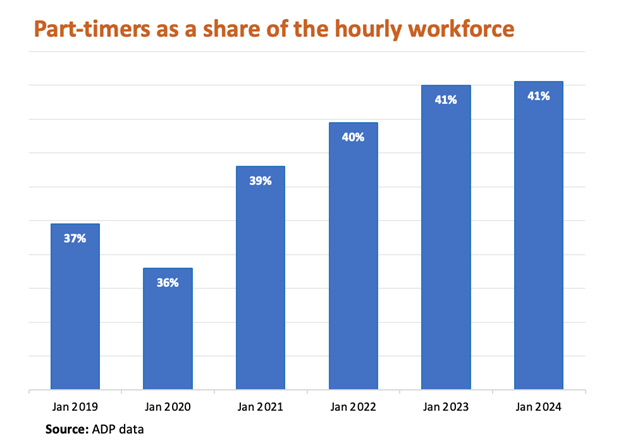

The rise of part-time workers

Part-time employees have grown from 37 percent of the hourly workforce in June 2019 to 41 percent in June 2024, according to ADP private payroll data. Over the last three years, the share of part-time workers has steadily crept up.

One reason: Restaurants and hotels have been massive job creators over the past three years. They also have a large share of part-timers.

A key question will be how long this swelling share of part-time workers lasts. If the share of part-timers falls back to pre-pandemic levels, it might signal broader-based hiring across industries that tend to have more full-time employment.

But as long as overall hiring continues to be concentrated in industries that rely on part-time workers, we expect this higher part-time share of workers to continue.

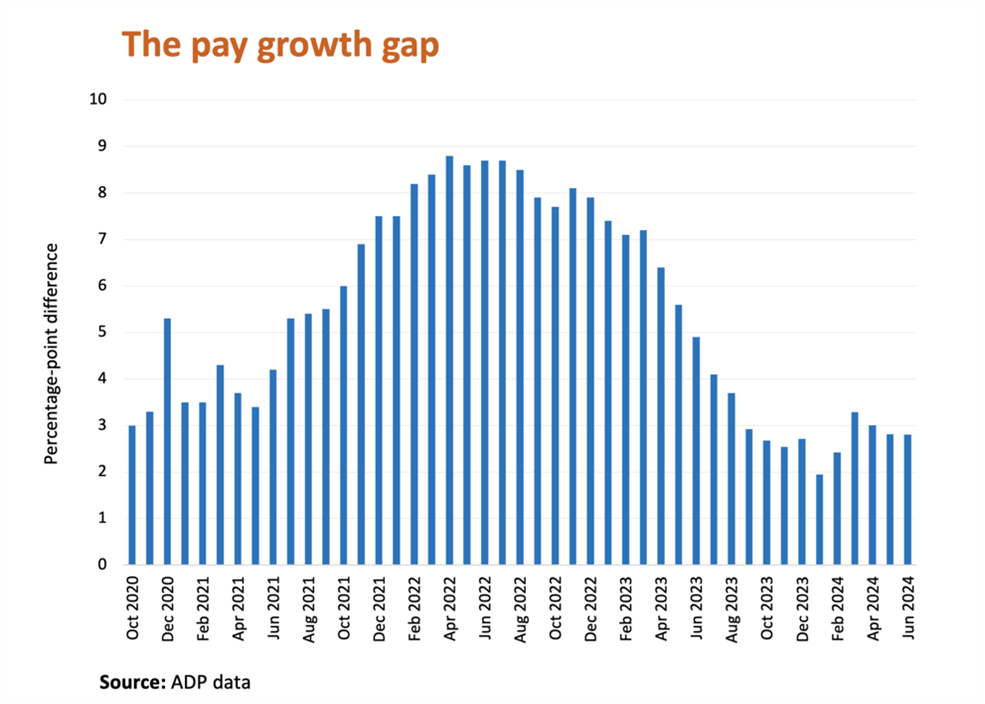

The wage gap

Wages are one part of the labor market that everyone pays attention to, whether they’re employers, workers, or monetary policymakers. This week, wage data might tell us even more than usual.

ADP Pay Insights data uniquely tracks anonymized individual workers over time. The result is the ability to monitor pay growth among people who stay in the same job from one year to the next (job-stayers) compared to people who jump to a new employer (job-changers). Job-changer pay growth is more sensitive to real-time labor market conditions.

The chart below plots these two data points to show the tightness of the labor market over time. For example, in June 2022, when employers were hiring at a rapid clip, the typical worker who switched jobs received a 9 percentage-point bump. By June of this year, the pay return on job switching had dropped to just 3 percentage points.

If gains from job switching stay low or fall even further, it could signal a continued cooling of the labor market.

My take

Economists often call the labor market a lagging indicator, meaning that it’s one of the slowest parts of the economy to react to changing economic conditions. I disagree.

The labor market is dynamic. Look in the right place and you’ll see signs of the economy’s direction.

Right now, the preponderance of jobs data shows a cooling but solid labor market. However, with hiring concentrated in sectors that depend on resilient consumer spending, such as leisure and hospitality, retail, and healthcare, the labor market also is signaling some vulnerability in the second half of the year.

The week ahead

Tuesday: A busy week of jobs data kicks off with the BLS Job Openings and Labor Turnover Survey. Two years ago, JOLTS data was the first sign of the Great Resignation and labor market tightness. These days, the report is likely to confirm what we already know, that demand for hiring is cooling but not crumbling.

Wednesday: This will be a big day for financial markets and Main Street. ADP will release the National Employment Report and Pay Insights in the morning and the Federal Reserve will have an interest rate decision in the afternoon. Market watchers will be tuned in to Chair Jerome Powell’s 2 p.m. press conference, listening for hints of a rate cut.

Thursday: The sleeper of the week might be BLS productivity data for the second quarter. In the first quarter, productivity, which measures output per worker, hit a three-year high. It factored into data last week that showed inflation had slowed even as economic growth accelerated. The only way this economic soft-landing scenario is sustainable is if the acceleration in productivity continues.

Friday: The week culminates with BLS non-farm payrolls data. Last month, over 70 percent of new jobs reported by BLS were in government and healthcare. I’ll be watching to see whether hiring has become more broad-based or remains confined to a hand