Main Street Macro: There’s still no foregone conclusion on inflation. Here’s why

September 16, 2024

|

It would be easy to ignore the economic news this week and pay attention only to Wednesday’s Federal Reserve vote on interest rates. I caution you: Don’t.

Even with a Fed meeting on the calendar, there will be much more important data news to watch. That’s because we still don’t know with certainty the future path of inflation. It could reach the Fed’s 2 percent target, or it might stabilize at a higher level or even rise.

In short, there’s still no forgone conclusion on inflation. Here’s why.

Pent-up consumer demand

Last week, the Fed released data showing that household net worth reached a record high.

In the first half of 2024, wealth grew 8.5 percent year-over-year. That’s the strongest performance since the 2021 pandemic-driven wealth rebound. Not counting large pandemic swings, one has to reach back all the way to 2014 to see such strong growth in household wealth.

What’s behind this growth? House prices.

The value of home equity in the United States soared to a record high $35 trillion in the second quarter of 2024, up 70 percent from $20.7 trillion in the second quarter of 2020. This massive growth was due to a combination of vigorous home appreciation and the rock-bottom mortgage rates we had prior to the pandemic.

The combination means that homeowners can now tap their home equity to fund other purchases, such as college tuition, far-flung vacations, and new cars, and pay down other debts. Low mortgage rates would make this borrowing cheaper, and houses could serve as ATMs for many owners.

Generally, an uptick in consumer demand due to lower rates is good for economic growth. But it calls into question the Fed’s ability to reach and sustain its inflation target.

The housing juggernaut

There’s another important reason that house prices and rents continue to play a large and lasting role in inflation. Inventory shortages have kept up price pressure on renters and buyers. Less than 1 percent of the nation’s housing stock was unoccupied in second quarter of 2024, according to the Census Bureau. That’s only half the nearly 40-year historical average.

Depleted stock leads to permanent price pressure. That’s one reason housing has persistently thwarted the Fed’s efforts to return inflation to pre-pandemic levels.

The push and pull of the labor market

Not all current trends point to increased inflation. On the deflationary side, workers have grown more productive.

Productivity, which economists measure as output per hour worked, is increasing faster than labor hours, according to the Bureau of Labor Statistics. Output grew 3.5 percent in the second quarter of 2024 while hours worked increased 1 percent. That adds up to a 2.5 percent productivity gain that could help contain prices now and in the future.

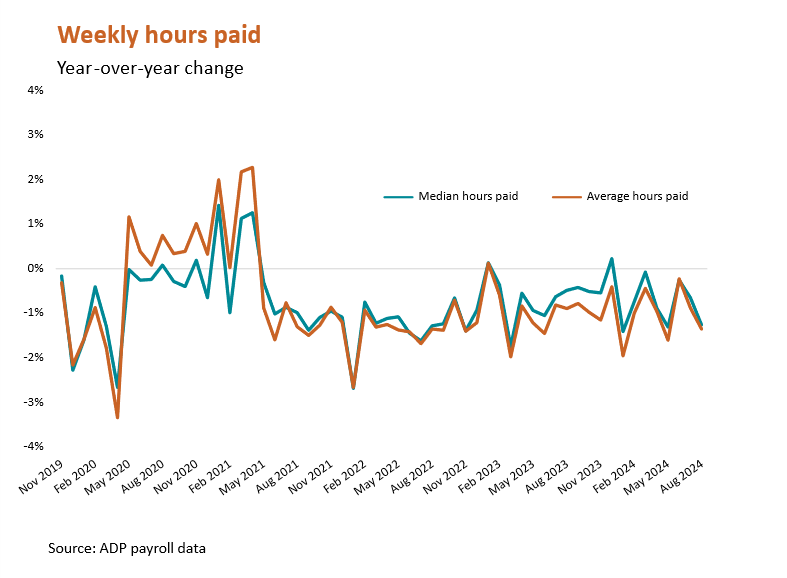

Somewhat surprisingly, this increase in productivity has occurred even as workers put in fewer hours. The year-over-year change in weekly hours worked has been negative every month since March 2021.

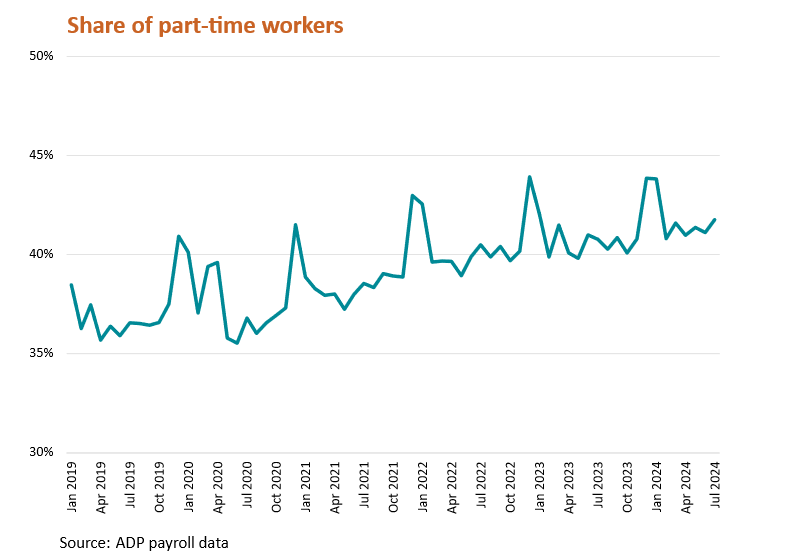

Moreover, the share of people working part-time has grown more than 3 percentage points, from 38.5 percent in January 2019 to 41.7 percent in August 2024.

This productivity boom might be just the beginning. Technological advances are promising to boosting productivity even more while lowering costs, and therefore prices.

My take

It would be easy to view a Fed rate cut as a victory lap on inflation. For sure, the worst of the pandemic price increases are behind us. For sure, inflation has been edging closer to the Fed’s target rate of 2 percent.

But the certainty ends there. High house prices, elevated wage gains, and productivity surges make the future path of inflation more difficult to predict than it has been historically. Personal Consumption Expenditures, the Fed’s preferred measure of inflation, remained at or below 2 percent for 150 months before the pandemic. The likelihood of the U.S. repeating this performance again is slim.

Rather than viewing the Fed decision this week as a victory lap in the inflation game, think of it as a single play in a much longer game.

For more on this subject, check out my discussion with Tom Keene and Paul Sweeney on Bloomberg Radio.

The Week Ahead

Tuesday: Retail sales data from the Census Bureau will provide a health check in on the consumer. Good news on consumer spending could help justify a 25-basis-point cut to the Fed’s benchmark interest rate this week instead of a more ambitious cut of 50 basis points. ADP Research also releases data on worker sentiment.

Wednesday: Data on housing starts from Census likely will be drowned out by reaction to the Federal Reserve rate decision later in the day. In the long run, however, the direction of housing supply ultimately will determine the sustainability of lower inflation.

Thursday: The August read on existing home sales from the National Association of Realtors will tell us how the housing market has responded to falling mortgage rates. A Fed rate cut could push mortgage costs even lower and boost homebuyer demand as well as prices.

And, in case you missed it: For a while, growth in wage garnishments was outpacing growth in wages. That changed with the pandemic. Jeff Nezaj at ADP Research has the analysis.