January job reports are different. Here’s why.

February 10, 2025

Every job report is important to economists, but the January releases stand apart. Not only do they set the tone for the year, they also introduce annual technical adjustments and benchmarking, which affects employment estimates all year.

Got questions? Here are some answers about January job reports.

Why do you benchmark the ADP National Employment Report?

Every January, we align estimates in the ADP employment sample to a comprehensive population benchmark called the Quarterly Census of Employment and Wages. The QCEW, which is derived from tax records filed by businesses as required by unemployment insurance laws, is a near-perfect read of all employment in the United States.

This near-perfect benchmark has one drawback: It’s available to the public only after a five-month delay. For economists, businesses, and investors, waiting several months for data on labor market conditions isn’t helpful for real-time decision making.

To remedy this delay, the ADP National Employment Report and the Bureau of Labor Statistics non-farm payroll report provide comprehensive and representative estimates of current-month changes in QCEW employment. In January, these estimates are anchored to the latest available benchmark of the QCEW (March 2024 – March 2023).

In this way, monthly job reports are aligned annually to the benchmark each year.

Now that the data have been revised, what does the job market look like?

In a word, strong. Private employers created 183,000 jobs in January, according to the ADP National Employment Report, continuing the strong hiring trend we saw at the end of 2024. The three-month moving average from November to January stands at 188,000 jobs.

After rebenchmarking, the three-month moving average for BLS private-sector hiring is at 209,000 jobs.

Both estimates signal strength in the U.S. job market over the past three months. The BLS report for January also delivered an unemployment rate of 4 percent, down from 4.1 percent in December.

But the strength of these headline numbers masks sector-level weakness. Almost all job growth in the National Employment Report was driven by the service sector, with two broad sectors—trade, transport and utilities, and leisure and hospitality—far outperforming all others.

In contrast, goods producers shed 6,000 jobs last month, with manufacturers leading the downturn in employment, and construction hiring modest. Business services had gains, but hiring overall has been modest compared to consumer-facing sectors.

OK, I get the big picture. What I really want to know is will I get a raise this year?

While we can’t guarantee that a raise is in any one person’s future, a wage increase is likely for the typical worker given current pay trends.

Beginning in January, we updated our payroll data from 14 million employees to more than 22 million. We also enhanced our ability to match the pay of individuals year-over-year, giving us a big bump in matched employee-job pairs, to 14.8 million from about 10 million.

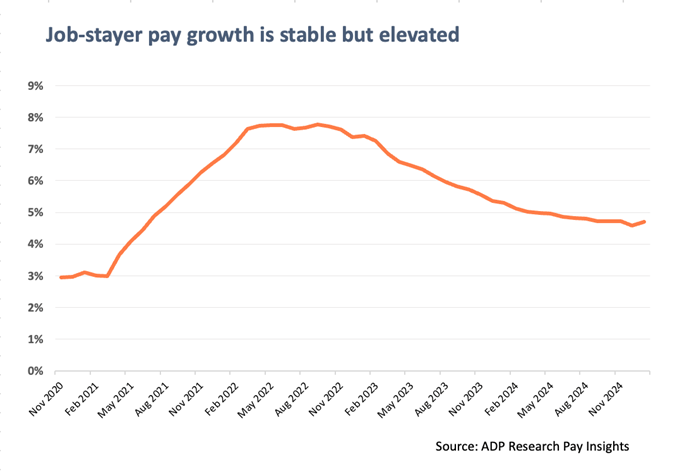

After slowing for 18 months, year-over-year pay growth for job-stayers has hovered around 4.7 percent for the past six months. At start of the series in November 2020, year-over-year pay gains were 2.9 percent.

The team at ADP Research watches wages closely. If pay growth accelerates too quickly, it could trigger higher inflation. If pay grows too slowly, it could dampen economic activity.

Stable but elevated wage gains are good for workers if—and this is a big if—inflation is stable and lower.

My take

Though pay growth remains solid, recent data shows that consumers still suffering from sticker shock on purchases. Consumer sentiment fell for the second straight month in February, to the lowest reading since July.

The University of Michigan sentiment survey also indicates that consumers expect big price jumps in 2025. Consumers dialed up their annual inflation expectations to 4.3 percent from 3.3 percent last month. Before the pandemic, consumers expected much more manageable inflation of 2 percent to 3 percent.

The first job reports of the year underline the fact that U.S. economic resilience is dependent on consumer-facing industries. Whether driven by short-term spending, such as restaurant visits, vacation travel, and concert tickets, or on the longer-term needs of an aging U.S. population, such as spending tied to health care, consumer services is leading labor market hiring now.

A downbeat consumer isn’t a dealbreaker for solid growth, but they could signal a headwind to hiring in the year ahead.

The week ahead

Wednesday: I’m looking at this week’s data through a consumer-focused lens. Consumer-driven hiring and heightened consumer inflation expectations amplify the importance of this week’s Consumer Price Index . I’m paying close attention to car and truck prices, which have had strong increases over the last three months. Inflation in other goods has been contained, but services, from insurance to shelter, have kept overall inflation solidly above the Federal Reserve’s 2 percent target.

Thursday: Wholesale prices, as reflected by the Producer Price Index, are a harbinger for future consumer prices. ADP Research will release data showing how the Los Angeles fires affected employment.

Friday: The proof is in the pudding, or in this case in retail sales. If higher prices finally start to crack consumer resolve, we should see signs of the strain in January retail sales data from the Census Bureau.

ICYMI: Chronic worker stress reached a new low in 2024, with the share of people reporting daily on-the-job stress plunging to 7.5 percent. Details can be found in the latest release from People at Work 2025.