Main Street Macro: It’s too soon to talk about a hard landing

August 05, 2024

|

In the days leading up to last week’s July jobs reports, positive GDP and inflation news had boosted investor confidence that a soft landing of the U.S. economy was not only achievable, but also close at hand.

That confidence turned suddenly on Friday on weaker-than-expected jobs data. Job gains fell from an average of 215,000 jobs a month over the preceding 12 months to just 114,000 in July, according to the Bureau of Labor Statistics. The unemployment rate increased from 4.1 percent to 4.3 percent.

The weaker data led many market watchers to worry anew about the risk of a hard landing that might lead to recession. The broad stock market closed down more than 1.8 percent.

But it’s probably too soon to use the R word. Here are three reasons why.

Employment is growing faster than it did before the pandemic

Friday’s non-farm payrolls report showed slower July job gains than the average for the preceding 12 months, but the United States continues to grow total employment at a faster pace than it did before the pandemic.

In July 2019, the workforce grew 1.3 percent year over year, adding just 90,000 jobs. Last month, employment was up 1.6 percent from a year ago, with 114,00 jobs created.

Through 2023, employers had to hire aggressively to replace workers they had lost during the pandemic and were forced to compete for talent during the Great Resignation. But those pandemic-initiated convulsions to the labor market have eased. Workers now are staying with their employers longer and quits are returning to pre-pandemic levels.

Companies that were hiring in July are growing their workforce, not just replacing fleeing workers.

More people are working, and workers are more productive

Two things were lost in last week’s labor market news.

The first was an increase in labor productivity, which economists measure as output per worker. After growing by only 0.4 percent in the first three months from a year earlier, labor productivity increased by 2.3 percent in the second quarter.

An increase in labor productivity is a win-win for the economy. When production grows faster than labor hours, wages rise and profits increase, which helps keep inflation at bay.

The second missed data point was that labor force participation for workers aged 24 to 54 rose to 84 percent in July, the highest level since 2001.

These numbers underscore the fact that job losses weren’t to blame for the small uptick in unemployment. Instead, the increase was driven largely by people entering the labor force, lured by higher wages.

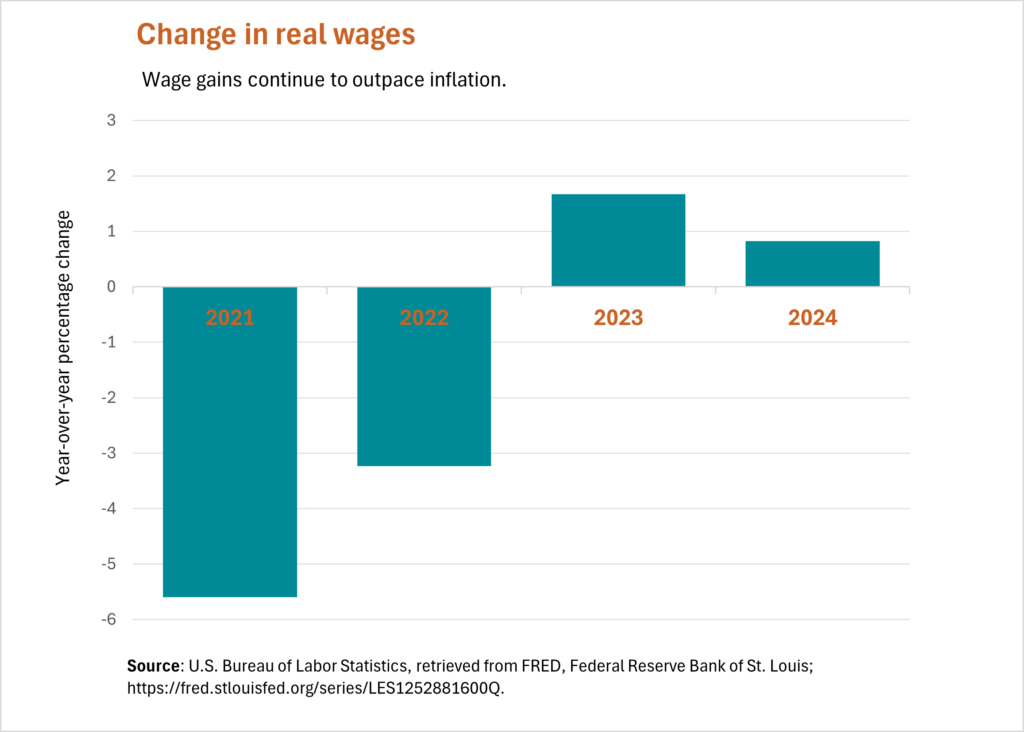

Wages still are rising faster than inflation

Wage growth accelerated rapidly during the pandemic, but even that strong growth couldn’t keep up with soaring inflation. Real wages, or wages adjusted for inflation, actually fell in 2021 and 2022.

Pay Insights data from ADP Research shows that pay growth is slowing and the premium that typically comes from switching jobs is shrinking. Still, as long as inflation keeps trending lower, positive real wage growth can continue to support consumer spending.

My Take

Over the last four years, economists and market watchers repeatedly have warned that a recession is close at hand, only to reverse their outlook when better economic data is released. This might be another one of those times.

Yes, the labor market is cooling. It’s taking longer for workers to get jobs. Hiring is slowing and the unemployment rate is rising from record lows closer toward historical averages. But none of that signals an imminent recession.

There’s a middle ground between a soft landing with steady job creation, which might be too optimistic, and hard landing with widespread job losses, which might be too dire. It’s a bumpy but safe landing, one in which inflation continues to abate and hiring increases modestly. July jobs data might just be reminding us what normal looks like.

The week ahead

Monday: After two busy weeks of data, this week is relatively light. On Monday, we get a fresh look at the service sector, which has been commanding the lion’s share of job gains. The monthly survey from the Institute of Supply Management likely will help economists gauge whether the slowdown in service-sector hiring we saw last month will continue.

Thursday: The Census Department’s monthly wholesale inventories report will provide clues on the state of manufacturing and whether production is likely to increase in coming months.

Also on Thursday, expect the weekly measure of initial jobless claims to get a close inspection after Friday’s weaker-than-expected jobs report. A jump in claims, which is seen as a proxy for layoffs, will deepen concerns that the labor market is cooling too fast.