MainStreet Macro: To pause or not to pause? Maybe that’s not the question

June 12, 2023

|

The Federal Reserve has raised interest rates 10 consecutive times, taking the benchmark federal funds rate from near zero up to more than 5 percent.

This week, Fed policymakers meet again to decide whether to move rates again – or not. Economists are divided as to whether the central bank should pause their rate hikes this month or keep them coming.

From a Main Street perspective, understanding the reason behind the Fed’s decision, whatever it might be, is as important as the decision itself. And it’s even more important to know that even if the Fed does take a pause, it’s likely to be temporary – the very definition of “pause”.

The big question isn’t to pause or not to pause. It’s how much longer will it take to defeat inflation.

Meanwhile, here are three questions Fed policymakers will be pondering this week as they debate whether to take a break, or raise rates for an 11th time.

Are higher borrowing costs putting a strain on consumers?

Total consumer credit increased 5.7 percent in April for the second straight month. That’s the fastest pace of growth since November, according to data from the central bank. Though consumer spending was surprisingly strong in April, households were borrowing more and saving less in the face of higher prices.

At the same time, the personal savings rate – saving as a percentage of disposable income—was 4.1 percent in April, down from 4.5 percent in March, according to the Bureau of Economic Analysis. Historically this rate has averaged upwards of 7 percent.

When consumers have less cushion to fund their purchases, they need to borrow to keep up their pace of spending. And these days, thanks to Fed tightening, borrowing comes with higher interest rates. Credit cards, car loans, and mortgages are all more expensive.

Consumer spending is 70 percent of economic growth. If it slows in the second half of the year, there’s a risk it could slow the economy, too.

Consumer spending data argues for a Fed pause.

Are home prices heating up?

Housing costs, for both renters and homeowners, currently account about 40 percent of inflation. A shortage of single-family homes in particular has helped keep inflation high for a lot longer than the Fed had hoped or expected.

Now housing prices nationally are heating up again after cooling earlier this year. Rental prices in April were up a whopping 8 percent from a year earlier, according to the Bureau of Labor Statistics. If the housing market gets a second wind, and purchase and rental prices soar anew, inflation could get its own second wind.

Home prices argue for another Fed rate increase.

Will companies increase prices to offset rising labor costs?

The greatest risk in a tight labor market is that rising wages lead companies to increase prices, which then leads workers to require higher salaries – an upward spiral of wage increases and price hikes.

Fortunately, the data suggests that this risk has been kept at bay. As we saw in the May jobs report, the labor market is still booming. But wages are decelerating.

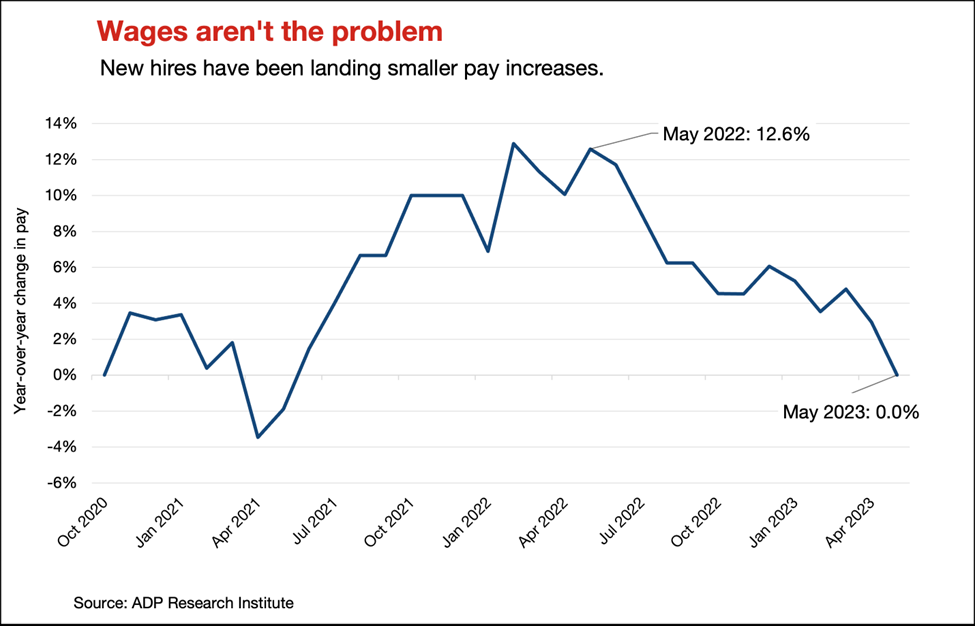

The chart below shows pay growth for new hires, people who joined their employers in the last three months. New hire pay is the most sensitive to real-time labor market conditions. Pay growth for new hires has declined sharply since May 2022, falling from 12 percent to zero in just 12 months.

Pay growth has also fallen for job stayers, people who have been with the same employer for the past 12 months or more. This pattern is broad-based, with every sector experiencing a pay slowdown. (Though the growth rates are still more than double their pace before the pandemic).

Pay data could argue for or against a rate increase. On one hand, year-over-year pay gains are still elevated. On the other hand, they’re slowing rapidly.

My Take

The data on consumers, housing, and pay growth are murky in the context of inflation fighting. Reasonable minds can look at the same numbers and disagree on the best move.

And there’s one more data point the Fed will be weighing before making its decision next week – inflation itself.

The Consumer Price Index, one of the most widely followed inflation metrics, will be released June 13, providing the freshest measure of Fed progress. Economists and policymakers will be looking for improvement from last month’s 4.9 percent read.

Even if the Fed does pause its inflation battle this month, it’s likely to be a temporary timeout to give the economy a chance to catch its breath after nearly a year of tightening. But in the long run, there’s still work to be done to get inflation down to the central bank’s 2 percent target, and businesses should be prepared for the possibility of more rate increases down the road.